Unlock your business’s full potential with integrated corporate advisory that goes beyond strategy – ensuring smooth transitions, sustainable growth and long-term success.

Integrated corporate advisory

OXYGY provides seamless, end-to-end support to ensure clarity, efficiency and strategic alignment at every stage of your M&A journey.

M&A sell-side

Management of enhancing stakes (total, majority, minority) of companies to institutional investors, industrial groups, and entrepreneurs; sales of business units, brands, and assets.

M&A buy-side

Management of the acquisition process of stakes, business units, brands, strategic assets, merger operations, alliances, joint ventures, and national or international buyouts; procurement

of medium to long-term financial resources (acquisition finance).

Financial strategy

Verification of financial needs (equity/debt) in the short and medium to long term strengthening and rebalancing of the snancial structure, capital increases; company, business unit, and brand valuations; financial planning.

Business strategy & integration

Analysis of financial debt and assessment of its sustainability; structuring and procurement of medium to long term shanking in the various available forms through credit institutions and capital markets; restructuring of existing debt.

IPO Advisory

Assistance in all phases of the project, from preparation to structuring of the most suitable financial instruments; consulting in the choice of the market, in the selection of the professional team, and in the definition of the placement price and volumes; support for placement activities.

Debt Advisory

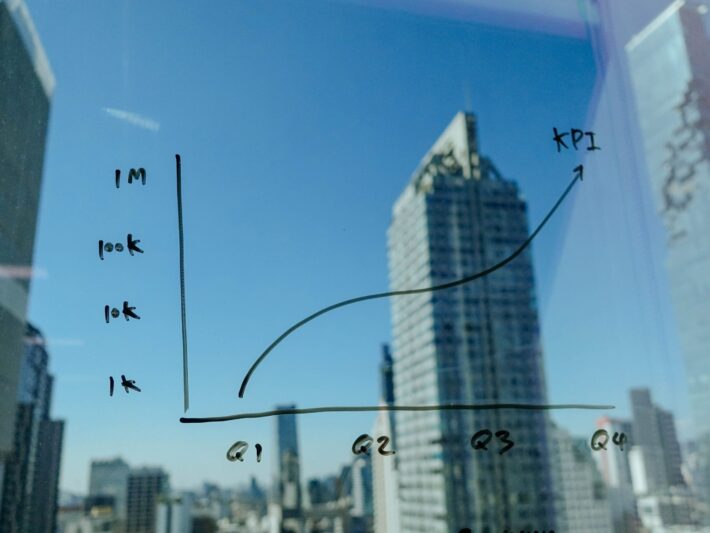

Strategic and financial review and evaluation of businesses, development of industrial plane; change management and planning, digital trane formation, post-M&A integrations, implementation of KPis and control systems; core ulting in the field of ESG, generational transitions, and governance.

At OXYGY, we offer end-to-end consultancy – covering business expansion and corporate finance advisory – to help you navigate complex M&A processes with confidence.

We support our clients through every stage of their growth journey:

Are you a company pursuing a significant acquisition or a series of deals?

Are you thinking of selling your company?

Are you looking for financing?

Is your company planning a major acquisition or a series of strategic deals?

OXYGY supports you at every stage – from acquisition planning to seamless post-merger integration – ensuring a smooth and successful transition.

Define the scope of the acquisition

Define goals, market positioning, and expected outcomes.

Select the potential targets

Shortlist candidates, review objectives, and start to gauge interest and information.

Conduct due diligence

Assess risks, validate data, and develop financial projections.

Negotiate the terms of the agreement

Align on value, synergies, and financial terms.

Integrate the target

Align organizations, address obstacles, and define ROI metrics.

Are you thinking of selling your company?

OXYGY can help you to go through all selling related aspects, from strategy to implementation

Pre-marketing

Identify potential investors, analyze market data, estimate company value, and prepare materials for market testing.

Marketing

Develop sale strategy, define key conditions, shortlist investors, and

initiate engagement with targets.

Define transaction

Review offers, transaction structure, and pricing; appoint legal and tax advisors.

Due diligence

Structure data room, coordinate due diligence activities, and conduct initial meetings with investors.

Negotiations

Support negotiations through signing, ensuring terms align with final objectives.

Are you looking for financing?

OXYGY can help you with implementing your growth strategy and maintaining a sustainable capital structure

Assess

Address investment needs to implement strategy. Structure a business plan and develop a financial model to highlight funding requirements.

Evaluate

Analyze financial performance and funding requirements. Develop a financial model for future projections.

Define

Determine optimal capital structure. Explore funding sources (e.g, private equity, grants, IPO).

Agree on

Finalize financing strategy and Information Memorandum. Negotiate terms with stakeholders (interest, repayments, covenants).

Closing

Complete the closing process. Set performance metrics and communicate progress to investors.

See How We Make Change Happen

Sustainable Growth Through Global Agility: Transforming Governance for a Global Chemical Leader

OXYGY partnered with a division of one of Japan’s largest chemical companies to enable a pivotal transformation. Tasked with moving from a "Japan-vs-the-rest-of-the-world" governance model to one that...

From Fragmentation to Focus: Uniting a Scattered Complex Multi-Entity Business Under One Vision

A multi-entity business group lacked a shared vision, leading to misalignment and inefficiencies across subsidiaries. OXYGY guided leadership through a structured process to co-create a Group Vision, align...

Engineering Growth: Bridging Design and Leadership to Shape Future Leaders

OXYGY collaborated with a global conglomerate to redefine their annual executive leadership development program. The initiative focused on identifying and nurturing future board-level candidates while...

Accelerating High-Performance Team Formation for a Multi-Billion-Dollar Divestment

When shareholders decided on a multi-billion-dollar divestment of a long-standing business unit within 18 months, the organization faced a significant challenge. OXYGY was brought in to help rapidly form...

Seamless Integration of Business Services from Multi-Billion Dollar Acquisitions into a Global Organization

OXYGY supported the seamless integration of business services from two multi-billion-dollar acquisitions into a global business services organization. The focus was on ensuring the smooth transition of...

Uniting Cultures to Drive Scientific Innovation

An Italian family-owned pharmaceutical company acquired a Scandinavian venture-funded firm with staff in Denmark and Sweden. The challenge was to integrate the new organization into the existing R&D function...

Restoring Momentum and Strengthening Global Operations

Following the merger of a U.S. and Swiss medical technology manufacturer, differences in organizational philosophies and cultural approaches led to significant delays in product launches. A structured...

Sustaining Growth with a Smarter Debt Strategy

A mid-sized multinational company required a refinancing solution to manage its existing debt, including a convertible bond approaching maturity. While supported by strong cash flows, the company's debt...

Taking Off: How an IPO Fueled Expansion in Airport Services

A multinational leader in airport services sought funding to accelerate its growth strategy through acquisitions and new tenders. Despite strong profitability and cash flow, the company needed a structured...

Unlocking Hidden Potential: Spinning Off and Scaling Up in the Aftermarket Sector

A multinational company sought to maximize the potential of its aftermarket business, a high-margin but historically overlooked unit within its portfolio. With a fragmented market landscape across Europe,...

Smart Acquisitions, Stronger Markets: A Structured M&A Approach

A mid-sized global manufacturer sought strategic guidance to refine its M&A approach amid increasing consolidation in the European market. With a strong position in its home country but varying competitiveness...